Saving the web from the AI browser

Let the internet stay weird.

Summary of article:

AI browsers turn sites from destinations into data pipes and your homepage will become an API.

Zero-click will rise as AI answers eat clicks & links must become invoices.

The shift from SEO to GEO requires permissions, origin, structure, to fix attribution and ship an explore mode.

There’s mass urgency to meter bots, track share-of-answer, pay where answers happen or the ecosystem thins out.

Let’s begin

There are two equally realistic consequences that stem from the AI browsers actually being used.

All human traffic is drained from the web

It funds better journalism

Finger’s crossed for number 2.

But.

It all depends on the ability of publishers and browsers to create a realistic co-exist strategy, filled with payments, citations (where content originated from) and a curated “explore” mode.

All before the AI web becomes too ingrained in it’s current form.

I’m about to drop some statistics that will make you shake in your boots.

But first.

An outlandish statement, rooted in facts.

Your homepage is becoming an API.

We’ve heard it 100 times already…

When an AI summary appears in Google search, people click through only 8% of the time.

Half the 15% rate when there’s no AI box.

The answer often ends the journey right there but ‘less clicking’ doesn’t have to mean ‘less paying’ because Cloudflare launched ‘Pay Per Crawl’ in June 2025 and now blocks many AI crawlers by default.

The web’s economics can shift from blue links to pay per access, if we move fast enough.

Why now

Your content is fetched, summarised and presented elsewhere.

The stakes are simple, if usage doesn’t translate into money and reputation, the supply of good content thins out.

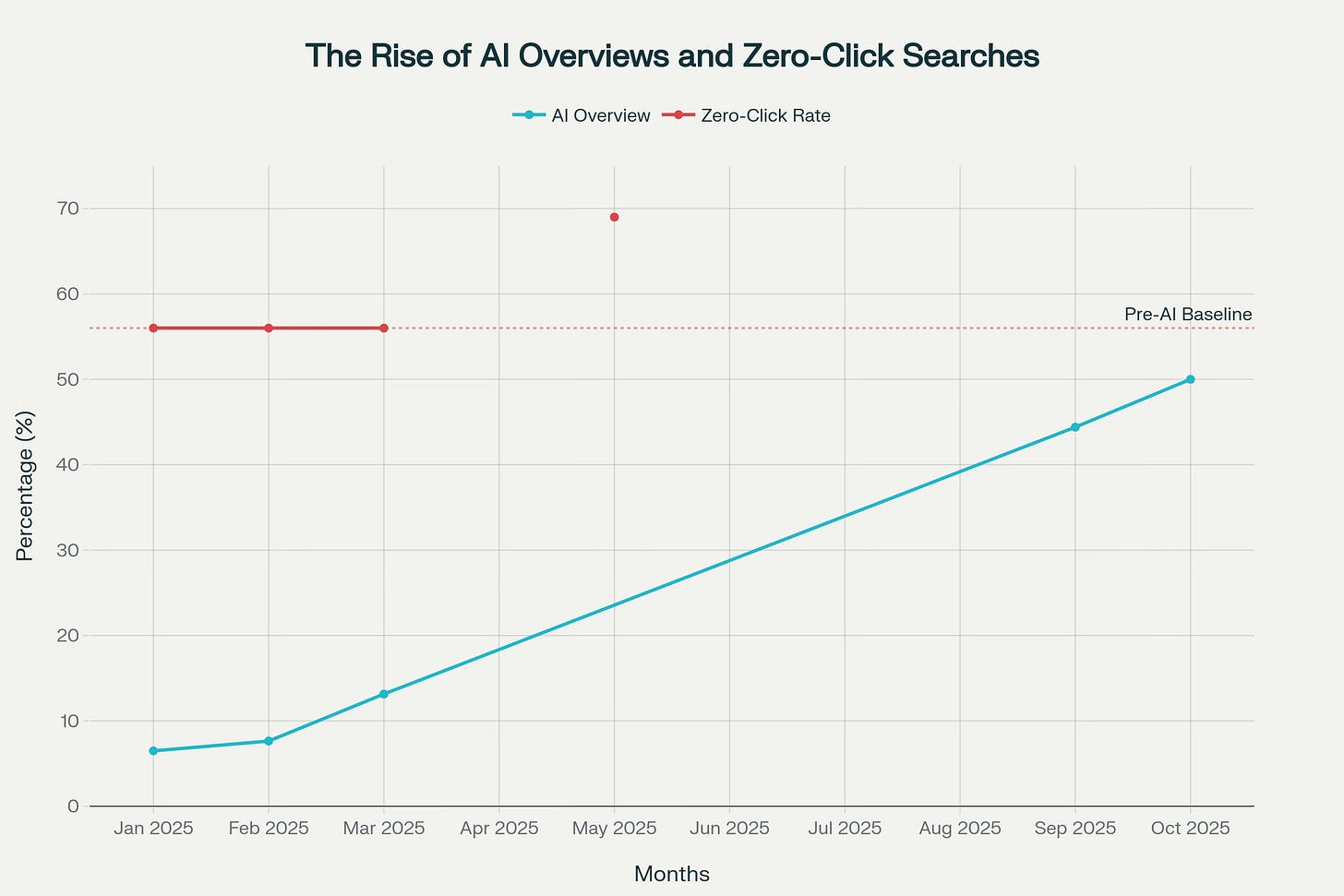

Google’s AI Overviews and ChatGPT Search normalise answer‑first UX and the rollout is accelerating.

Early rollbacks after the infamous “glue on pizza” fiasco looked like retreat.

Unfortunately, a16‑month BrightEdge study tracking millions of keywords found AI Overview coverage rising to 44.4% overall by September 2025 and a staggering 85% for informational queries.

By October, AI Overviews appeared in over half of all search results.

The “answers on top” pattern isn’t maturing, it’s spreading.

The velocity is uneven but relentless. Couple of key ones:

Healthcare queries jumped from 72% AI Overview presence in 2024 to 87% in 2025.

Education queries exploded from 18% to 87%, a 69‑percentage‑point surge in twelve months.

Entertainment queries saw a 528% increase in AI Overview presence between March 2024 and March 2025.

Restaurant and travel followed at 387% and 381% respectively.

Vertical by vertical, the AI box is eating the page.

Zero‑click is the logical endpoint.

Between May 2024 and May 2025, the share of searches ending without a click grew from 56% to 69%.

Thirteen percentage points of traffic that simply evaporated.

Not because users didn’t find value, but because they got it without leaving Google.

How the ecosystem collapses

Four actions taken by you:

You search “best portable monitors.”

The AI overview stitches pros, cons, and specs.

It then lists three models with prices.

You get what you came for, and you don’t click.

The review site that funded the teardown, photographed the ports, and measured the colour accuracy loses the visit.

The magic is real, but the economics that produced the review go missing.

The next teardown doesn’t get funded.

Multiply that pattern across medicine, law, recipes, tutorials, investigations and you don’t get a UX problem but you get an ecosystem collapse.

Ooooo scary.

Let’s play fetch.

Now for the statistic drops I promised earlier.

Links will become invoices for real time crawlers.

Why?

Traffic is softening where AI summaries show up and the numbers are consistent across studies.

Ahrefs analyzed 300,000 keywords and found position‑one CTR dropped from 7.3% to 2.6% year‑over‑year when AI Overviews appeared.

A 34.5% decline.

BrightEdge reported an average 30% CTR drop since May 2024.

Digital Content Next members saw a 1–25% traffic range depending on vertical, with many clustering around the 25% mark by August 2025.

In the worst cases?

DMG Media reported an 89% CTR decline for certain searches to the UK’s Competition and Markets Authority in July.

The pattern also varies by vertical but not by direction.

CNN lost roughly 30% of referral traffic from Google. Business Insider and HuffPost shed closer to 40%.

Entertainment, restaurant, and travel sites, categories that saw AI Overview presence surge by 300–500% bore the brunt earliest.

Healthcare and education now triggering AI Overviews 87% of the time are watching the same erosion play out in slow motion.

BUT value isn’t vanishing.

It’s moving.

Smart publishers are converting “used but not visited” into “licensed and credited.”

News Corp’s multi‑year OpenAI deal, reportedly worth over $250 million across five years, about $50 million annually, created a template.

Financial Times, Time, The Atlantic, and Vox followed with their own OpenAI agreements.

Dotdash Meredith locked in a minimum $16 million per year.

Wiley reported $40 million in AI licensing revenue for fiscal 2025, nearly doubling the prior year.

Curiosity Stream projected $19.6 million from AI licensing in 2025.

The marginal unit of value is no longer a page view but a permitted fetch.

In fact, the real‑time retrieval side is exploding at an accelerating pace.

TollBit tracked a 49% surge in retrieval bots, in live answer‑generation agents in Q1 2025.

By Q2, human visits to publisher sites fell 9.4% while AI bot traffic quadrupled.

By June, one in every fifty site visitors was an AI bot, up from one in two hundred at the start of the year.

AI bot traffic now exceeds Microsoft’s Bingbot, making it a larger crawling force than the world’s second‑largest search engine.

Meanwhile, 26 million scrapes bypassed robots.txt in March 2025 alone.

A single month.

Let that sink in.

The share of bots ignoring robots.txt jumped from 3.3% in Q4 2024 to 12.9% in Q1 2025.

Cloudflare formalised the obvious in June 2025, launching default AI‑crawler blocking and Pay Per Crawl.

The new “paywall” sits at the bot boundary and the CDN layer becomes the cashier.

Early adopters include some of the largest publishers and platforms on the web like Condé Nast, Associated Press, Reddit, Pinterest, Time, BuzzFeed and O’Reilly Media.

Google’s crawl‑to‑referral ratio worsened by 24.4% in Q2 despite Googlebot making 34.8% more requests.

The obvious translation… Google is taking more and giving back less.

From SEO to GEO

Traditional SEO fought for position on a list.

In AI answers, the interface must justify inclusion, not just placement.

That shifts optimisation from keywords and backlinks to clarity (claims backed by evidence), origin (who said what, when), and permission (license signals).

The research community is already framing tactics as GEO by making content more likely to be selected and cited by generative engines.

Research from Princeton, Georgia Tech, and the Allen Institute for AI identified the most effective GEO tactics through rigorous testing across multiple models.

Adding expert quotations delivers a 41% visibility improvement.

The strongest single optimisation.

Some other significant ranking factors:

Statistics and cited sources each boost visibility by 30%.

Enhanced fluency adds 22%

Technical terminology increases it by 21%

Authoritative tone contributes 11%

Notably, traditional keyword stuffing now reduces AI visibility by 9%, confirming that GEO rewards substance over gaming.

The citation landscape also varies by interface.

Google’s AI Mode, its conversational search interface that launched in the UK in July 2025 , favours brands (90% inclusion rate) and stability, pulling from five to seven source cards per response.

Week‑to‑week volatility is low. If you rank, you stay.

AI Overviews, in contrast, cite brands only 43% of the time but include 20+ inline citations per response and exhibit 30x higher week‑to‑week volatility.

It’s a faster‑moving but less predictable ranking environment.

For publishers, that means dual optimisation.

The content being comprehensive enough for AI Mode’s breadth whilst being authoritative enough for AI Overviews’ selectivity.

In fact, 54% of AI Overview citations match the top ten organic results, but 46% come from outside the top ten.

That’s nearly half the cited sources bypassing traditional SEO entirely, pulled in based on relevance signals the old algorithms missed.

Traditional rank‑and‑yank SEO still matters for the majority, but GEO opens a side door for deep, well‑structured content that never cracked page one.

There’s a catch though.

Up and coming vendors like perplexity who employ a growth at all cost mentality are being found out, quick.

Authority is wobbly without guardrails.

Perplexity faced repeated allegations through 2024 of ignoring robots.txt via indirect scrapers.

AWS opened an internal probe in June 2024 after reports Perplexity violated platform rules.

In September 2025, Encyclopedia Britannica and Merriam‑Webster sued Perplexity for “unlawful copying of reference material.”

The pattern illustrates why permission and provenance matter beyond compliance, they’re trust signals.

Engines that foreground licensing and source panels will earn credibility, while publishers that sign and structure their work will win inclusion.

Attribution quality remains dire.

Columbia’s Tow Center tested ChatGPT Search in December 2024, asking it to attribute 200 quotes from recent news articles.

The AI misattributed sources 76.5% of the time, or 153 out of 200.

It often cited plagiarised or syndicated versions instead of original publishers, even for outlets with OpenAI licensing agreements.

Only seven responses acknowledged uncertainty, the rest delivered confident but wrong citations.

Publishers blocking OpenAI’s crawler still saw their content misrepresented.

Google’s knobs are moving, but in both directions.

It briefly dialled back AI Overviews after the glue‑on‑pizza debacle in May 2024, then expanded coverage with clearer intent boundaries through 2025.

Users can force a link‑only view via the Web filter.

An escape hatch that preserves traditional search when needed.

Time to kiss the ring?

Publishers with OpenAI licensing deals see 7x higher click‑through rates from ChatGPT Search than those without agreements and 88% more scraping.

However, the referral conversion is substantially better.

The pattern shows up across multiple industry reads.

Fewer clicks, but better ones.

A 7x CTR multiplier sounds great until you realise it’s 7x of nearly zero.

ChatGPT still sends 831x fewer visitors than Google as of September 2025.

The durable fix is usage‑based licensing plus visible credit.

When money follows mentions and mentions expose diverse sources publishers are paid to go deep again and users can see where the answer came from.

That’s the only model that keeps the long tail funded.

Time is running out

Zero‑click is coming, BUT zero‑click doesn’t have to be zero‑sum.

If we turn the homepage into an API, the link into a receipt, and the answer box into a map, the web stays alive and strange.

The destination changes but the value doesn’t.

The infrastructure exists.

The deals are being signed.

The lawsuits are clarifying the rules.

What’s missing is urgency.

Every day we delay shipping Explore Mode, publishing share‑of‑answer metrics, and enforcing Pay Per Crawl is another day habits harden around free, frictionless, uncredited consumption.

We know how this movie ends if we do nothing.

We’ve watched social platforms hollow out media before.

The AI shift is faster and the stakes are higher, because the content isn’t just redistributed, it’s dissolved into answers and reconstituted without attribution.

We also know what works.

Payments that follow usage, orgin that survives summaries and interfaces that reward curiosity alongside efficiency.

The web won’t die. It will invoice.

If we ship the right systems before the defaults lock in, those invoices will actually get paid.

The homepage is an API now.

The question is whether it’s an API you control, or one that simply takes what it needs and moves on.

Until next time,

Blake